What are the best solar rebates and incentives in 2023?

Written by Emily Walker

Updated 8/4/23

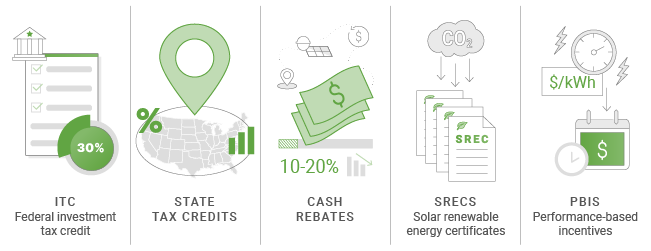

While the cost of solar has declined significantly over the last decade, it’s still a sizable investment for home and business owners looking to lower their electric bills. To encourage the greater adoption of solar, the federal government, state, and local governments, and even some utilities offer incentives to make putting solar on your roof and powering your home with clean energy more affordable and accessible. These energy savings typically take the form of solar rebates, tax benefits, or performance-based incentives, and can reduce the cost you pay for solar from anywhere from 30-50%!

Key takeaways

- The best solar incentive is the federal investment tax credit, which provides a credit worth 30% of your system costs on your federal tax bill.

- You may be able to further lower your installation costs through solar rebates from your state or utility company, installer, or equipment manufacturer.

- If you’re a business owner, you may qualify for additional solar incentives that could lower your solar energy system price by about 70%!

- Some of the friendliest states for solar include New York, Rhode Island, Iowa, Connecticut, and Maryland.

- Visit the EnergySage Marketplace to compare multiple quotes from vetted solar installers.

Major solar rebates and solar incentives

- Investment tax credits

- State tax credits

- Cash rebates

- Net metering

- Solar renewable energy credits (SRECs)

- Performance-based initiatives

- Incentives for businesses

- Subsidized loans

- Tax exemptions

Why the Investment Tax Credit is the best solar incentive

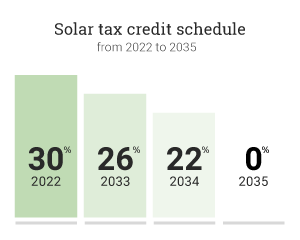

The federal investment tax credit (ITC) is far and away the best solar incentive, providing 30% of your solar project costs as a credit towards your federal income taxes. Instead of a deduction, which reduces your taxable income (as would happen with any charitable donations you make in a year), a tax credit directly offsets what you would otherwise owe in taxes. Instead of just being taxed on a lower income, the federal ITC offsets what you actually owe in taxes, and can even come back to you as a refund from the IRS if you've overpaid your taxes during the year (but it won't exceed your tax liability). Here are the specifics:

- 2016 – 2019: the energy tax credit remained at 30% of the cost of the system.

- 2020 – 2021: owners of new residential and commercial solar earned a credit of 26% of the cost of the system for their federal income tax bill.

- 2022 – 2032: owners of new residential solar can earn a credit of 30% of the cost of the system for their tax bill. Commercial solar systems will also be eligible for 30 percent until 2025, at which point the U.S. Department of Treasury will determine if the ITC will continue for commercial systems.

- 2033: owners of new residential solar can earn a credit of 26% of the installation costs of the system for their tax bill.

- 2034: owners of new residential solar can earn a credit of 22% of the installation costs of the system for their tax bill.

- 2035: there is no federal credit for residential solar energy systems starting this year.

Learn more about the investment tax credit, including FAQs.

How can you claim the Investment Tax Credit?

There are 3 main steps to claiming the ITC:

- Determine if you’re eligible: To be eligible for the Federal ITC, you need to own your solar system (rather than lease it) and live in it for part of the year. You also need to have enough tax liability (the ITC is not a refund), though you can carry over any remaining credits to the following years, as long as the ITC is in effect.

- Complete IRS Form 5695: This form validates your qualification for renewable energy credits. To complete the form, you’ll need to enter your solar energy system costs, determine your tax liability, and calculate your tax credit.

- Add your credit value to Schedule 3 and IRS Form 1040: Finally, you’ll need to enter your tax credit value to the Schedule 3 form (and attach it to Form 5695) and to your regular tax form, Form 1040.

For more information, read our full instructions on how to claim the ITC.

Do states offer tax credits?

Some states offer additional tax credits for installing a solar photovoltaic panel system, functioning much the same way as the federal ITC does but for your state taxes. These amounts vary significantly by state, but, when paired with the federal ITC, can really add up!

What types of solar rebates exist?

Some states, municipalities, and utility companies offer up-front rebates for installing a solar panel system. Three primary types of rebates exist: government or utility company rebates, installer rebates, and equipment manufacturer rebates.

1. Rebates from state governments and/or utility companies

Rebates from your state and/or utility company can further lower your system costs by 10-20% and are generally only available for a limited time, disappearing once a certain amount of solar has been installed in your region. They can sometimes involve an intricate application process, but these types of rebates are often the most lucrative, making it well worth any extra effort.

The rules behind applying for state or utility rebates are typically stricter than the requirements for other types of rebates. You may find that there are restrictions on the type of equipment you can use, on minimum or maximum system size requirements, or on which installers you can work with (and what certifications/licensing they need). For example, to claim the Megawatt Rebate incentive in New York, you need to work with a pre-vetted, state-approved contractor.

Because of these regulations, applying for a state or utility rebate often requires submitting detailed information about your solar equipment and system design, performance expectations, project costs, and/or installation company. More often than not, your solar installer will apply for these types of rebates on your behalf, or assist you with the process. Keep in mind that your local government and/or utility company may not pay you out for the rebate directly; sometimes, they give the rebate to your installation company, who simply subtracts the incentive amount from what they charge you.

2. Rebates from installers

You may come across some installation companies offering seasonal rebates and other types of limited-time promotions to customers that move forward with them. If that’s the case, you likely don’t need to deal with a separate rebate application: you’ll simply sign the installation contract, and they’ll take the rebate amount directly out of your total costs.

3. Rebates from solar equipment manufacturers

Solar equipment manufacturers are increasingly offering rebates for installing their products. If your solar panel or inverter company has a promotion like this, you can likely apply for the rebate directly on their website. In order to receive the rebate, you may need to provide proof of installation, such as a photo, signed contract, and/or verification from your utility company that your system is up and running.

Some manufacturers also partner with EnergySage to offer rebates to people who install their products after finding an installer through our platform. If you’re claiming an equipment rebate through EnergySage, you’ll work directly with us once to receive the incentive once your system is up and running.

How you can earn credits for solar production with net metering

When the sun’s shining, your solar panel system will likely produce more electricity than you need. If your state or utility company offers a net metering policy, you’ll receive credits from your local utility company for this excess electricity that you send to the grid. When you need to pull electricity from the grid, it will count against the credits you’ve banked over time. At the end of your billing cycle, you’ll only be billed for your “net” energy consumption. Sometimes, your bills will even be $0 or show a credit balance with net metering!

What are solar renewable energy certificates?

Many states now have renewable portfolio standards, which require utilities to procure or generate a certain percentage of their electricity from renewable resources, including solar power. If you live in one of these states, your solar panels will create solar renewable energy certificates (SRECs) for the amount of electricity produced by your solar panel system. Utilities buy your SRECs as a form of compliance with state-level renewable energy requirements, given that each SREC is representative of the environmental attributes of your solar generation. Selling your SRECs can result in hundreds (or even thousands) of dollars more per year in income, depending on the SREC market in your state.

What are performance-based incentives?

Another common form of solar incentive program is the performance-based incentive, or PBI, which pays you a per kilowatt-hour credit for the electricity that your system produces. PBI programs are slightly different from SREC programs in one key way: while SRECs represent the environmental attributes of solar generation (i.e., emission reductions), PBI programs provide an incentive for the electricity produced itself (i.e., the kilowatt-hours of production). Unlike SRECs, PBIs don’t have to be sold through a market, and incentive rates are determined when the system is installed. PBIs can both replace or exist alongside net metering policies.

Do special solar incentives exist for businesses?

In addition to the ITC, rebates, SRECs, and PBIs, there are some solar incentives only available to businesses.. Depending on where your business is located, the various solar incentives available to your business could be worth about 70% of the cost of your solar panel system!

- Modified Accelerated Cost Recovery System (MACRS): a depreciation benefit that allows you to recover the value of your solar assets over an accelerated time frame; for solar this time frame is five years at the federal level. Some states also have MACRS available to businesses.

- Bonus depreciation: a depreciation-based tax incentive available to businesses that invest in solar, but you’re able to take the full benefit in the first year of your investment.

For businesses, you must choose between MACRS and bonus depreciation, depending on what works best for you and your company.

Financing incentives: Subsidized loans

You may be eligible to finance your solar panel system purchase using a subsidized solar loan with a reduced interest rate. These loans may be offered by your state, a non-government organization, or your utility company, but are usually only available for a limited time.

Are solar panel systems tax-exempt?

Some states and municipalities don’t include the value of solar panel systems in property taxes assessments. This means that, even though the value of your property has increased by the addition of a solar power system (by 4% on average!), your property tax bill won’t increase; – it will remain the same.

In addition, your solar panel system may be exempt from state sales taxes, which can result in significant additional savings depending on your state’s sales tax rate.

Are you eligible for solar incentives if you don't own your system?

Eligibility is dependent on whether you are the owner of your solar panel system or not. If you buy your system upfront or with a solar loan, you’re eligible to receive tax credits, solar rebates, and SRECs for the system. However, if you lease your system, the third-party owner will receive all of the solar incentives.

What are the friendliest states for solar?

Going solar is a good investment for most people anywhere, but some states are making it extremely worthwhile to invest in a solar system. The following states are making going solar so cost-effective that residents should be asking if they can afford to not go solar!

New York

New York has the widest range of solar incentives and programs available in the United States. In addition to the federal ITC, they offer:

- The Megawatt Block Incentive, a direct, generous incentive for solar energy available under New York’s ambitious NY-Sun Initiative. The program provides an up front dollars-per-watt ($/W) rebate for both commercial and residential solar panel systems;

- Net metering;

- A solar equipment tax credit of 25% or up to $5,000;

- And the NY Sun Initiative, an umbrella program for many solar initiatives including community solar.

There’s never been a better time to go solar if you’re from the Empire State!

Rhode Island

Though it may be the smallest state in the US, Rhode Island is at the head of the pack when it comes to enticing solar incentives. In combination with the ITC, they also offer:

- A solar grant program that can save consumers up to $5,000;

- The Residential Solar Energy Property Tax Exemption, which means your property taxes will not increase as a result of the value your new solar panels add to your home;

- The Renewable Energy Products Sales and Use Tax Exemption, which means you will not have to pay any tax on your purchase of your new solar energy system;

- Net metering;

- And, National Grid’s Renewable Energy Growth program, from which consumers will receive 28.75 cents for each kilowatt-hour (kWh) their solar panel system generates for the first 15 years of their system.

With solar policies like this, it’s only a matter of time before the entire state installs solar panels!

Iowa

Residents of Iowa are in luck when it comes to solar incentives. When stacked with the ITC, theses incentives make it a no-brainer to go solar in Iowa:

- Favorable solar easement and rights laws that allow you to install even in the face of things like HOAs that might otherwise get in your way;

- Net metering;

- A five year property tax exemption for the value of your solar system;

- And, a sales tax exemption for electrical equipment that will save you six percent on your purchase price.

Take advantage of these incentives by signing up for the EnergySage Marketplace.

Connecticut

If you’re thinking about going solar, Connecticut is a great place to do it. On top of the ITC, residents are able to stack the following incentives:

- The Smart-E energy efficiency loan program of up to $40,000 for 5-12 years at a 4-7 percent interest rate;

- Net metering;

- The Sales and Use Tax Exemption for Solar and Geothermal Systems, which means that you won’t have to pay any taxes on the purchase of your system;

- And, the Property Tax Exemption for Renewable Energy Systems, which means you won’t have to pay any additional taxes on the increased value of your home as a result of installing solar.

Connecticut’s plethora of incentive options makes it an easy decision to install solar in the Nutmeg State.

Maryland

Mayland has set ambitious clean energy goals, and is backing them up with great solar incentives. Residents can take advantage of the ITC and the following incentives:

- The Maryland solar rebate program that will pay you $1,000 for installing a solar system;

- One of the best SREC incentive programs in the country;

- Net metering;

- The Property Tax Exemption for Solar and Wind Energy Systems, keeping you from paying any extra taxes on the increased value of your home due to solar;

- And, a tax-free purchase through the Sales and Use Tax Exemption for Renewable Energy Equipment.

If you’re a Maryland resident, you can help the state meet its goals by lowering your electric bills and saving with solar!

What incentives are available in your state?

Even if you don't live in one of the friendliest states for solar, your state by still offer unique incentives only available to its residents. If you’re curious as to what your state offers to help offset the cost of going solar, check out our state rebates and incentives pages. Below is an abridged database of additional state incentives that may be available to you, pulling from EnergySage and DSIRE.

- Arizona: the Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels, up to $1,000, right off of your personal income tax in the year you install the system.

- California: California offers a net billing program and California’s Disadvantaged Communities - Single-family Solar Homes (DAC-SASH) program provides upfront rebates to income-eligible, single-family homeowners installing solar panels. Homeowners must be customers of Pacific Gas and Electric (PG&E), Southern California Edison (SCE), or San Diego Gas and Electric (SDG&E) to take advantage of the incentive.

- Colorado: the Sales and Use Tax Exemption for Renewable Energy Equipment means that there won’t be any sales tax on the purchase of your system and the Property Tax Exemption for Residential Renewable Energy Equipment keeps you from having to pay any additional taxes on the increased value of your house.

- Delaware: thanks to Delaware’s net metering policy, you will be able to sell energy generated by your solar panels back to the grid in exchange for credits on your energy bills.

- Florida: due to Florida’s Property Tax Exclusion for Residential Renewable Energy Property, your solar system will not result in any additional costs on tax day.

- Georgia: under Georgia’s net metering policy, participating utilities will measure the amount of excess solar electricity you put on the grid and pay you a rate determined by Georgia’s Public Service Commission.

- Illinois: under the Adjustable Block Program, also known as Illinois Shines, you can earn one solar renewable energy certificate (SREC) for each megawatt-hour (MWh) of electricity your solar system produces over 15 years. For the average residential system, this comes out to more than $10,000 in additional savings.

- Indiana: thanks to the Indiana renewable energy property tax exemption, for any new solar PV system installed in Indiana, the assessed value of the system is exempt from your property taxes – this means that even though your solar installation adds value to your property, the added value can’t be counted when the property is being assessed for taxes.

- Louisiana: the Louisiana Department of Natural Resources offers low-interest home improvement loans to homeowners who go solar or conduct other energy efficiency measures on their property.

- Massachusetts: under the MA renewable income offer, the owner of a renewable energy system gets a 15 percent coverage of the system cost against his or her MA income tax with a $1000 maximum credit amount.

- Maine: Maine's Home Energy Loan program allows you to borrow as much as $15,000 for up to 15 years – interest rates are as low as 4.99 percent.

- Michigan: this MI financing option offers homeowners the chance to upgrade their home’s energy efficiency with loans that have APR as low as 4.99 percent, depending on their credit score.

- Minnesota: when you install solar panels on your home in Minnesota, you don’t have to pay any sales tax on your solar purchase: considering that state sales tax is nearly 7 percent, the sales tax exemption means major solar savings.

- Missouri: in addition to getting discounts and rebates on the cost of your solar installation, all solar homeowners in Missouri are exempt from property tax increases that result from installing solar panels on their homes.

- North Carolina: the value that solar adds to a property isn’t included in property tax assessments thanks to this property tax exemption.

- New Hampshire: in the state of New Hampshire, you will be exempt from paying property taxes on the additional value solar adds to your home.

- New Jersey: under the SuSI, or SREC-II program, you can generate one SREC-II for every megawatt-hour (MWh) your solar panel system generates.

- New Mexico: under New Mexico’s solar tax credit, you can reduce your state tax payments by up to $6,000 or 10 percent off your total solar energy expenses (whichever is lower).

- Nevada: Nevada has solar access laws that protect your right to install and generate electricity with solar panels. In Nevada, no contract or other legal document (like homeowner’s association bylaws) can prohibit homeowners from installing solar.

- Ohio: Ohio has created the Energy Conservation for Ohioans (ECO-Link) Program to make it less expensive for you to finance your solar energy system.

- Oklahoma: Net metering in Oklahoma allows you to sell any excess solar electricity you generate back to the grid in exchange for credits.

- Oregon: Oregon law states that any change in real market value to property due to the installation of a qualifying renewable energy system is exempt from assessment of the property’s value for property tax purposes.

- Pennsylvania: Net metering is strong in Pennsylvania, allowing you to receive credits on the energy generated by your solar panels.

- South Carolina: South Carolina's state tax credit for solar energy allows residents to claim 25 percent of their solar costs as a tax credit – and if you don’t pay enough in taxes to get the full value of the credit in one year, it carries over for up to 10 years.

- Texas: although Texas doesn’t have a statewide net metering policy, many utilities in the state (including El Paso Electric, the City of Brenham, CPS Energy, and Green Mountain Energy) have policies that credit owners of solar energy systems for the electricity that their panels produce.

- Utah: if you install a solar panel system on your home in Utah, the state government will give you a credit towards next year’s income taxes to reduce your solar costs. You can claim 25 percent of your total equipment and installation costs, up to $800.

- Virginia: when you sign up for net metering in Virginia, you get credits on your electricity bill for every extra kilowatt-hour of solar electricity that you send back to the grid.

- Vermont: the Renewable Energy Systems Sales Tax Exemption frees you from paying any sales tax on the purchase of your system, and the Uniform Capacity Tax and Exemption for Solar keeps you from having to pay increased property taxes.

- Washington: solar energy systems 10 kW or less in size are eligible for a 100 percent exemption from sales and use tax. Purchasers of these systems can provide the seller with an exemption certificate to avoid paying the sales and use tax.

- Wisconsin: Wisconsin solar access rights grant homeowners the right to have unrestricted access to the sun, so when you install solar panels, you can rest assured that your neighbors won’t be able to do anything that obstructs your source of solar energy.

- Washington D.C.: the Solar Advantage Plus Program is a first-come, first-served rebate program that provides qualified applications with up to $10,000 to cover the full cost of a 3kW to 4kW solar system.

Go solar with confidence through EnergySage

EnergySage is the nation's online solar marketplace; when you sign up for a free account, we connect you with vetted solar installers in your area, who compete for your business with custom solar quotes tailored to fit your needs. Over 10 million people come to EnergySage each year to learn about, shop for, and invest in solar. Sign up today to see how much solar can save you.